Why It Matters

The move will provide Arm’s parent company, SoftBank, with more capital to further invest in start-ups. In a recent meeting with investors and analysts, SoftBank’s chief executive, Masayoshi Son, said the company was ready to shift to “offense” in the field of artificial intelligence.

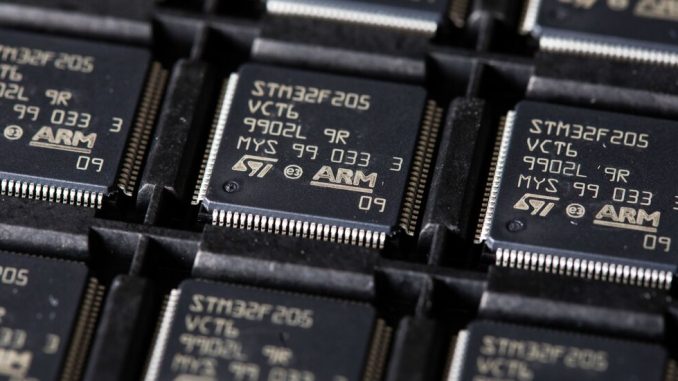

In the filing, Arm said more than 30 billion Arm-manufactured chips were shipped last fiscal year. SoftBank will remain Arm’s controlling shareholder.

Background

Arm, a 33-year-old company, develops and licenses blueprints for microprocessors that other companies turn into chips. Its energy-efficient technology played a major role in fueling the mobile phone boom, including every iPhone that Apple has sold since 2007.

But Arm technology is also found in myriad other products, including home appliances, cars and industrial equipment. The company estimates that more than 250 billion Arm-based chips had been sold.

Arm was a public company until 2016, when SoftBank bought it for $32 billion. Nvidia made its bid for the company in September 2020, but ran into vocal opposition from regulators and some major chip companies.

SoftBank has taken huge losses since that failed acquisition, posting a $3.3 billion loss in this year’s first quarter. The Vision Fund, which is SoftBank’s technology investment arm, noted a net loss of $3.3 billion but an investment gain of $1.1 billion in the second quarter, after a loss of $23.1 billion a year earlier.

What’s Next

The I.P.O. filing means Arm can begin to gauge investor interest, which will be critical to the share sale. The company will still need to say how much it plans to raise in the offering, and what valuation it is seeking, something it will do closer to the sale.

Rene Haas, who has been Arm’s chief executive since February 2022, has pushed the company to move into more lucrative areas, including data center servers operated by companies like Amazon. How well that effort is faring, as well as the names of any high-profile investors and potential changes to Arm’s business model to bring in more revenue, is likely to be a key topic for investors studying its offering prospectus.

Be the first to comment