Home buyers, entrepreneurs and public officials are confronting a new reality: If they want to hold off on big purchases or investments until borrowing is less expensive, it’s probably going to be a long wait.

Governments are paying more to borrow money for new schools and parks. Developers are struggling to find loans to buy lots and build homes. Companies, forced to refinance debts at sharply higher interest rates, are more likely to lay off employees — especially if they were already operating with little or no profits.

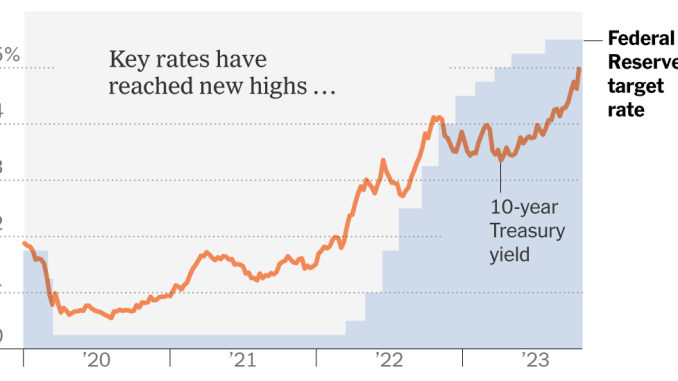

Over the past few weeks, investors have realized that even with the Federal Reserve nearing an end to its increases in short-term interest rates, market-based measures of long-term borrowing costs have continued rising. In short, the economy may no longer be able to avoid a sharper slowdown.

“It’s a trickle-down effect for everyone,” said Mary Kay Bates, the chief executive of Bank Midwest in Spirit Lake, Iowa.

Small banks like Ms. Bates’s are at the epicenter of America’s credit crunch for small businesses. During the pandemic, with the Fed’s benchmark interest rate near zero and consumers piling up savings in bank accounts, she could make loans at 3 to 4 percent. She also put money into safe securities, like government bonds.

But when the Fed’s rate started rocketing up, the value of Bank Midwest’s securities portfolio fell — meaning that if Ms. Bates sold the bonds to fund more loans, she would have to take a steep loss. Deposits were also waning, as consumers spent down their savings and moved money into higher-yielding assets.

As a result, Ms. Bates is making loans by borrowing money from the Fed and other banks, which is more expensive. She is also paying customers higher rates on deposits.

For all those reasons, Ms. Bates is charging borrowers higher rates and being careful about who she lends to.

“We’re not looking at rates coming down any time soon,” she said. “I really see us taking a close watch and an internal focus, not so much on innovating and getting into new markets but taking care of the bank we have.”

On the other side of that equation are people like Liz Field, who started a bakery, the Cheesecakery, out of her home in Cincinnati, focusing on miniature cheesecakes, of which she has developed 200 flavors. She gradually built her business up through catering and mobile food trucks until 2019, when she borrowed $30,000 to open a cafe.

In 2021, Ms. Field was ready for the next step: buying a property including a building to use as a commissary kitchen. She got a loan for $434,000, backed by the Small Business Administration, with an interest rate of 5.5 percent and a monthly payment of $2,400.

But in the second half of 2022, the payments started increasing. Ms. Field realized that her interest was pegged to the “prime rate,” which moves up and down with the rate the Fed controls. Because of that, her monthly payments have climbed to $4,120. Along with slowing cheesecake orders, she has been forced to cut her 25 employees’ hours, and sell one food truck and a freezer van.

“That really hurts, because I could have one to two shops for that price,” Ms. Field said about her payments. “I’m not going to be able to open more stores until I get this big loan under control.”

According to analysts from Goldman Sachs, interest payments for small businesses will on average rise to about 7 percent of revenues next year, from 5.8 percent in 2021. No one is sure when businesses may get some relief — though if the economy slows sharply enough, rates are likely to sink on their own.

For much of 2023, many investors, consumers and corporate executives eagerly anticipated rate cuts next year, expecting the Fed to determine that it had beaten inflation for good.

Surprised by the persistence of price increases even after supply chains started to untangle, the Fed proceeded with its most aggressive campaign of interest rate increases since the 1980s, raising rates by 5.25 percentage points over a year and a half.

Yet the economy continued to burn hot, with job openings outstripping the supply of workers and consumers spending freely. Some categories driving inflation sank back quickly, like furniture and food, while others — like energy — have resurged.

In September, the central bank held its rate steady, but signaled that the rate would stay high for longer than the market had anticipated. For many businesses, that has required changes.

“We’ve been in this environment where the best strategy has been to just hold your breath and wait for the cost of capital to come back down,” said Gregory Daco, chief economist at the consulting firm EY-Parthenon. “What we’re starting to see is business leaders, and to some extent consumers as well, realize that they have to start swimming.”

For large businesses, that means making investments that are likely to pay off quickly, rather than spending on speculative bets. For start-ups, which proliferated over the last few years, the concern is about the survival or failure of their businesses.

Most entrepreneurs use their savings and help from friends and family to start businesses; only about 10 percent rely on bank loans. Luke Pardue, an economist at the small-business payroll provider Gusto, said the pandemic generation of new firms tended to have an advantage because they had lower costs and used business models that catered to hybrid work.

But the high cost and scarcity of capital could prevent them from growing — especially when their owners don’t have wealthy investors or homes to borrow against.

“We spent three years patting ourselves on the back seeing this surge in entrepreneurship among women and people of color,” Mr. Pardue said. “Now when the rubber meets the road and they start to struggle, we need to enter the next phase of that conversation, which is how we can support these new businesses.”

New businesses aren’t the only ones struggling. Older ones are, too, especially when prices for their goods are falling.

Take agriculture. Commodity prices have been dropping, helping to bring down overall inflation, but that has depressed farm income. At the same time, high interest rates have made buying new equipment more expensive.

Anne Schwagerl and her husband grow corn and soybeans on 1,100 acres in west central Minnesota. They’re gradually buying the land from his parents, with favorable terms making up for high interest. But their line of credit carries an 8 percent interest rate, which is forcing them to make tough decisions, like whether to invest in new equipment now or wait a year.

“It would be really nice to get another good grain cart so we can keep the combine moving during harvest season,” Ms. Schwagerl said. “Not being able to afford that because we’re putting off those kinds of financial decisions just means we’re less efficient on our farm.”

The stubbornly high cost of capital also hurts businesses that need it to build homes — when mortgage rates above 7 percent have put buying homes out of reach for many people.

Residential construction activity has taken a hit over the past year, with employment in the industry flattening out as interest rates suppressed home sales. Builders that secured financing before rates increased are offering discounts to get units sold or leased, according to the National Association of Home Builders.

The real problem may arrive in a couple of years, when a new generation of renters begins searching for properties that never got built because of high borrowing costs.

Dave Rippe is a former head of economic development for Nebraska who now spends some of his time rehabilitating old buildings in Hastings, a town of 25,000 people near the Kansas border, into apartments and retail spaces. That was easier two years ago, when interest rates were half what they are now, even though material costs were higher.

“If you go around and talk to developers about ‘Hey, what’s your next project?’ it’s crickets,” said Mr. Rippe, who is looking into government programs that offer low-cost loans for affordable housing projects.

Through all of this, consumers have kept spending, even as they’ve run through pandemic-era savings and started to rely on expensive credit card debt. So far, that willingness to spend has been made possible by a strong job market. That could change, as the pace of pay increases slows.

Car dealers may feel that shift soon. In recent years, dealers made up for low inventory by raising prices. Carmakers have been offering promotional interest deals, but the average interest rate on new four-year auto loans has climbed to 8.3 percent, the highest level since the early 2000s.

Liza Borches is the president of Carter Myers Automotive, a Virginia dealership that sells cars from many brands. She said automakers had been churning out too many expensive trucks and sport utility vehicles and should switch to making more of the affordable vehicles that many customers wanted.

“That adjustment needs to happen quickly,” Ms. Borches said.

Of course, interest rates aren’t a factor for those who have cash to buy cars outright, and Ms. Borches has seen more customers putting down more money to minimize financing costs. Those customers can also earn a good return by keeping cash in a high-yield savings account or money market fund.

The era of higher-for-longer rates is less advantageous for those who have to borrow for day-to-day needs and are also dealing with rising housing costs and subdued pay growth.

Kristin Pugh sees both kinds of people in her Atlanta practice as a financial adviser for wealthy individuals, who waives her fees for some low-income clients. It’s a picture of diverging fortunes.

“Coupled with higher rents and stagnant wages, the pro bono clients are not going to fare as well in higher interest rate environments,” Ms. Pugh said. “It’s just mathematically impossible.”

Be the first to comment