MANILA, Philippines — Our fast-paced world is characterized by rapidly changing trends, which presents a unique challenge in building a lasting legacy. How do we remain relevant and consistently deliver exceptional service and products when customer needs and demographics change, technology provides new ways of execution and local and international markets provide unique opportunities?

As the Bank of the Philippine Islands (BPI) celebrated its 173rd anniversary (last month), this is an important reflection for us. We have seen many changes in the country’s social, economic and political landscape. Because of this, we have always aspired to go beyond our usual services. That is why, in light of this milestone, we have challenged ourselves to do more: more innovation, stronger growth and greater community impact.

Balancing innovation and trust

Doing more means adapting to changes and responding to the demands of changing consumer behavior. This has been evident in how we continue to pursue digitalization because of the increasing demand for digital financial services among Filipinos.

The rising consumer demand for digital financial services may be due to various technological and demographic factors.

For instance, the Digital 2024: Global Overview Report published by DataReportal stated that there were 86.98 million internet users in the country at the start of 2024, with internet penetration standing at 73.6 percent.

Demographically, the consumer landscape is evolving with a rise in young, tech-savvy individuals who seamlessly integrate mobile apps into their day-to-day transactions.

With these developments, financial institutions must respond to the demands of consumers. Thus, we continue to develop products and services that cater to these technological needs.

However, threat actors have also taken advantage of these developments. In fact, the Philippine National Police Anti-Cybercrime Group reported that, from January to August of 2023, Filipinos lost at least P155.2 million from scams. It is against this backdrop that we strive to balance innovation and ensure that our clients trust our services and our ability to protect their assets and information from any form of threat.

Elevating consumer protection

We know the distress and trauma that scam victims go through, thus this problem cannot be taken lightly. This is why banks are committed to improving their cybersecurity systems and infrastructure. However, the ingenuity of threat actors calls for stronger measures that will deter cybercriminals from targeting the banking public, especially in the digital space.

In addressing this problem, we focused on consumer protection. This means that whatever solution we develop, it must be beneficial to consumers and must prioritize their needs. Another consideration is the long-term viability of the solution.

This refers to creating an enabling policy environment that will uphold the credibility of financial systems and foster cooperation between the government and financial institutions to fight the rise of financial cybercrime.

By taking all these together, we decided to elevate consumer protection through policy reform. Our goal was to complement our cybersecurity efforts with institutionalizing consumer protection at the national level.

Together with the Bankers Association of the Philippines (BAP), BPI advocated for a game-changing piece of legislation that penalizes both scammers and money mules: the Anti-Financial Account Scamming Act (AFASA).

Signed into law on July 20, this policy will help deter financial scams and in effect promotes the efficiency and security of digital payments.

What does the AFASA do? The law penalizes social engineering schemes like phishing, vishing and other scams that result in unauthorized access to financial accounts. It also prohibits individuals from acting as money mules who obtain, receive, deposit, transfer and withdraw funds derived from criminal activities.

Finally, AFASA defines money muling activities and social engineering schemes as forms of economic sabotage, which sends a message that these financial cybercrimes can significantly damage the country’s economy.

AFASA’s passage was made possible by the efforts of various stakeholders, including lawmakers, the Bangko Sentral ng Pilipinas, and the banking industry. Sen. Mark Villar and Rep. Irwin Tieng, chairs of their respective banks committees, championed the policy. The BSP did likewise and ensured the policy’s prioritization, paving the way for the AFASA to be included in the administration’s list of priority legislative measures last year.

Embodying whole-of-nation

Our efforts did not stop with legislative advocacy. To boost public and private collaboration in the fight against cybercrimes, we held the BPI Cybersecurity and Consumer Protection Conference on July 31, 2024.

With the theme “Securing Consumer Trust and Fortifying Cyber-Resilience in an AI World,” we brought together more than 200 participants, including government officials, cybersecurity professionals, media practitioners and students.

The conference was also graced by esteemed speakers, including Villar; Department of Information and Communications Technology Secretary Ivan John Uy, Privacy Commissioner John Henry Naga, Cybercrime Investigation and Coordinating Center Undersecretary Alexander Ramos and Trade Undersecretary Amanda Marie Nograles.

As the first Filipino bank to host a conference focused on both cybersecurity and consumer protection, BPI highlighted emerging trends and best practices to bolster consumer trust in the digital age.

This is how we truly embody the meaning of a whole-of-nation approach. From the start, we recognized that we cannot operate in silos if we want to respond to the evolving nature of financial cybercrimes.

It cannot be denied that the financial threat landscape continues to change. All the more reason to work together, lend our expertise and address the issue through a policy-oriented and whole-of-society approach. This is the best way to foster good governance and institutionalize financial consumer protection.

Beyond legacies

The initiatives discussed above tell us three things. First, we take consumer protection very seriously. Our customers will always be at the center of everything that we do, thus we must innovate and adapt to their needs. These innovations may come in the form of products, services, and even policies.

Second, we understand the evolving nature of financial threats vis-a-vis technological advancements. We will continue to collaborate with the government and other stakeholders to respond to these potential threats. Lastly, we strive to make a lasting mark on the Filipino community by maintaining the integrity of our systems and safeguarding financial services from fraud and cyber threats.

It is clear that we will continue to witness more technological advancements and developments in our cybersecurity landscape. We may not be able to predict where these challenges and opportunities will lead us, but what remains constant is BPI’s commitment to building on our 173-year legacy of consumer protection and customer obsession. We will stay ahead of the curve and create innovative and safe financial solutions to exemplify banking excellence anchored on trust and the best digital offers.

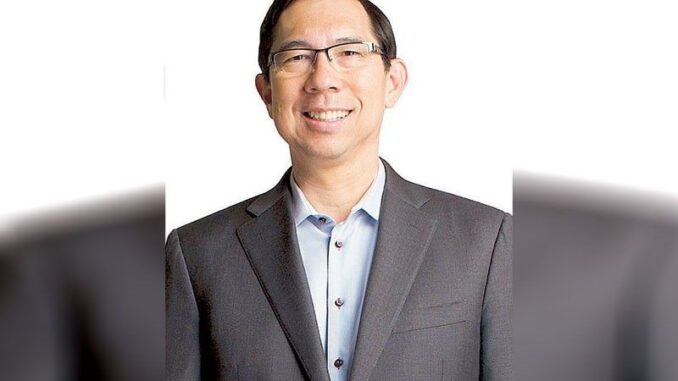

Jose Teodoro “TG” Limcaoco is the president and CEO of the Bank of the Philippine Islands. He is also the President of the Bankers Association of the Philippines.

Be the first to comment