The US Federal Reserve [link] slashed interest rates by 50 basis points (bp) earlier this morning, exceeding the 25 bp consensus estimate. This is the first time rates have been cut in the US since 2020, and it comes as the Fed says that it has “greater confidence” that inflation is heading back into a normal range. In its statement, Fed officials noted that job gains have slowed, but that the Fed is “strongly committed to support maximum employment.”

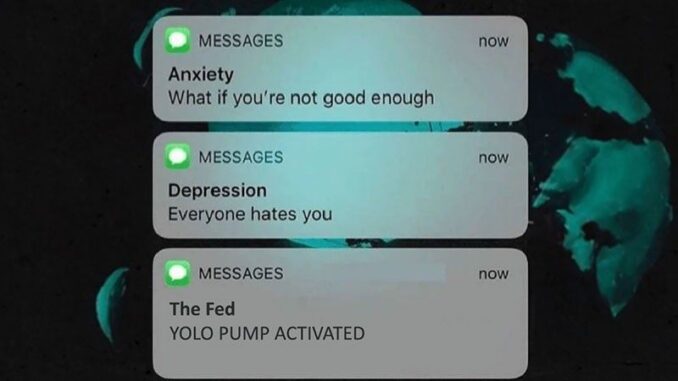

MB bottom-line: The much-anticipated pivot is finally here, and yet this move seemed to catch the US market by surprise. Lots of threads immediately filled up with comments like “panic cut”, “election year”, and “buy gold”, with most non-professionals seeming uncertain about how to consume the news. Once traders and analysts sweated out the shock of what happened through their pores, the cool reality of an uncertain path forward was all that seemed to remain. The size of the cut suggests a certain level of concern for the health of the US job market and an ailing job market is always in the conversation when talk turns to recession. By the same token, the size of the cut prompted plenty of analysts to wonder aloud about future CPI readings and whether this move would reignite inflationary pressures that the Fed has fought for so long to tamp down with its four-year regime of hawkish high rates. The DOW immediately pumped up a couple of hundred points (it’s fallen back a bit at the time of this writing) after spending the morning moderately lower heading into the Fed’s announcement. My eyes are wandering to the gold spot price (gold is seen as a “hedge” to inflation); it’s up 1% as of this writing to $2,595.80/ounce. Bitcoin is up as well, though its role as a hedge to inflation is not so clearly defined. There’s bound to be a lot of movement today, as it seemed like the Fed allowed an uncharacteristic level of uncertainty to build heading into this announcement; uncertainty leads to volatility, and volatility to opportunity. Keep your eyes open today!

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Be the first to comment