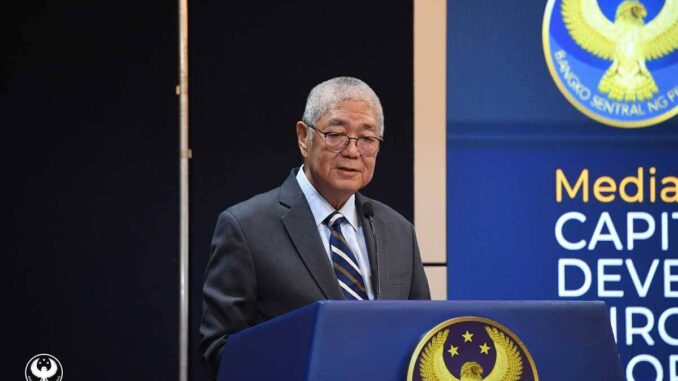

THE Philippines is expected to exit a global dirty money watchlist February next after a watchdog found the country to have acted on previously identified deficiencies, Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. said.

“This is a very significant step for us,” Remolona told The Manila Times in a text message.

The Paris-based Financial Action Task Force (FATF) late on Friday said that the Philippines — which has been on the “gray” list of jurisdictions under increased monitoring since 2021 — had “substantially completed its action plan” to strengthen the effectiveness of its anti-money laundering and combating the financing of terrorism (AML/CFT) systems.

An onsite assessment will now follow to “verify that the implementation of AML/CFT has begun and is being sustained and that the necessary political commitment remains in place to sustain implementation in the future.”

Asked when the Philippines could possibly expect to be removed from the gray list, Remolona replied “February.”

FATF President Elisa de Anda Madrazo told reporters on Friday that the onsite review would involve a team of experts and that “we will expect an answer on … [whether the country will exit the list] in February of 2025.”

The FATF, in its latest assessment, said the Philippines had implemented key reforms, including:

– demonstrating that risk-based supervision of designated non-financial businesses and professions (DNFBPs, which include casinos, real estate agencies, and casinos) is occurring;

– demonstrating that supervisors are using AML/CFT controls to mitigate risks associated with casino junkets;

– implementing the new registration requirements for money or value transfer services and applying sanctions to unregistered and illegal remittance operators;

– enhancing and streamlining law enforcement agency access to beneficial ownership (BO) information and taking steps to ensure that BO information is accurate and up-to-date;

– demonstrating an increase in the use of financial intelligence and an increase in money laundering investigations and prosecutions in line with risk;

– demonstrating an increase in the identification, investigation and prosecution of terrorism financing cases;

– demonstrating that appropriate measures are taken with respect to the non-profit organization (NPO) sector (including unregistered ones) without disrupting legitimate activities; and

– enhancing the effectiveness of the targeted financial sanctions framework for both terrorism and proliferation financing.

When the watchdog kept the Philippines on the gray list for a third straight year during its previous meeting in June, it told the country to “swiftly implement its action plan” as “all deadlines had expired in 2023.”

President Ferdinand Marcos Jr. in January this year ordered all agencies concerned to work on securing an October exit.

Executive Secretary Lucas Bersamin, who also chairs the National Anti-Money Laundering and Combating of Terrorism Financing/Counter-Proliferation Financing Coordinating Committee, said the government was confident that the progress made “will be affirmed during the on-site visit.”

“We must continue our efforts to ensure that our reforms are implemented and sustained. Building a resilient AML/CTF (combating terrorism financing) regime is critical for safeguarding our financial system and our economy from illicit activities,” he added.

Inclusion in the gray list means increased monitoring by the FATF and a commitment to quickly resolve identified deficiencies. It is a step up from being blacklisted, which happened to the Philippines in 2000 and led to economic penalties.

The country only exited the “black” list in 2005 after the 2001 passage of the Anti-Money Laundering Act and a subsequent 2003 amendment.

It was placed on the “gray” list in 2010; however, due to the lack of counter-terrorism financing laws and was downgraded to the “dark gray” list in February 2012.

It was later upgraded to the “gray” list in June of that year and finally exited in 2013 with the passage of the Terrorism Financing Prevention and Suppression Act of 2012.

It remained on a watchlist, however, until 2017 with the passage of the Casino Law, and following a 2018 evaluation, it was returned to the “gray” list in 2021.

The FATF currently classifies North Korea, Myanmar and Iran as “high-risk jurisdictions subject to a call for action,” also known as the black list.

In the category of “jurisdictions under Increased monitoring” — the gray list — are Algeria, Angola, Bulgaria, Burkina Faso, Cameroon, the Ivory Coast, Croatia, Congo, Haiti, Kenya, Lebanon, Mali, Monaco, Mozambique, Namibia, Nigeria, the Philippines, South Africa, South Sudan, Syria, Tanzania, Venezuela, Vietnam and Yemen.

Senegal was removed from the gray list last Friday, while Algeria, Angola, the Ivory Coast and Lebanon were added.

Be the first to comment