The Philippine peso slid to a record low of 59 per dollar last Thursday. This matched the previous low on October 2022 before the peso recovered to close at 58.87 on Friday. The peso’s decline follows Donald Trump’s recent election victory which has reignited concerns over his inflationary economic policies. The dollar is also set for its longest bull run in more than a year as rising geopolitical tensions boost demand for the haven currency. Last Friday, the dollar’s strength helped send the euro to its lowest level since 2022.

Trump policies boost dollar

As we highlighted in a recent article, “Dollar Makes a U-turn” (Oct. 21), Trump’s policies – characterized by tax cuts, tariff hikes, anti-immigration stance and the potential for an intensified trade war with China – are expected to drive volatility and bolster the US dollar. While his trade war is primarily directed at China, vulnerable economies like the Philippines are caught in the crossfire.

BSP: Peso decline driven by strong dollar narrative

Despite the retest of record lows, the Bangko Sentral ng Pilipinas stated that the peso’s decline follows broader regional and global trends. “The recent depreciation of the peso against the dollar is driven by a strong dollar narrative amid rising geopolitical tensions,” the BSP said in a statement last Friday. “The peso traded in line with regional currencies we benchmark against.”

Peso weakness in perspective

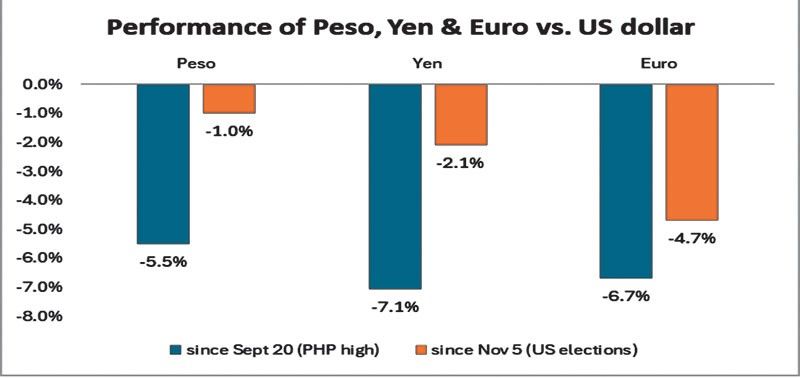

The table below shows that the Philippine peso has fared relatively better than many of its counterparts since Trump’s election on Nov. 5. The peso weakened by one percent during this period, while regional currencies declined by an average of 1.6 percent and major currencies fell by 2.6 percent.

From Nov. 5, the Malaysian ringgit fell by 2.7 percent, the Thai baht and Singaporean dollar dropped by 2.5 percent, and the euro tumbled by 4.7 percent. These figures highlight the peso’s performance has been relatively stable despite the dollar’s broad-based strength and heightened geopolitical tensions.

Dollar’s rise linked to Trump’s rising odds

The peso’s weakness began even before Trump’s election victory. This was indicated by shifts in US political betting markets and was reflected in the dollar gaining strength. As of Sept. 23, Polymarket, the world’s largest prediction market, gave Trump 46.9 percent odds compared to vice president Kamala Harris’ 52 percent. By early Oct. 8, Trump had overtaken Harris and his odds of winning reached 54 percent while Harris fell to 45.8 percent. This coincided with a surge in the dollar’s rally.

Peso performs better than yen and euro

While the peso has declined in step with the strengthening US dollar, its performance since its recent high of 55.47 on Sept. 20 has fared well against major global currencies like the yen and the euro. During this period, the peso has weakened by 5.5 percent compared to a 7.1-percent drop for the yen and a 6.7-percent decline for the euro.

The trend continues when measured from Nov. 5 (US election date). The peso has fallen by only one percent, outperforming the yen which declined by two percent and the euro which dropped by 4.7 percent. Market pundits are even forecasting that the euro will reach parity with the dollar.

Dollar strength, not peso weakness

As shown by the double-digit year-to-date declines in the Mexican peso and Brazilian real, the big declines in the yen, euro and Korean won, the dollar remains strong against almost all currencies. As the BSP said, it’s the dollar strength that’s driving most currencies lower. To mitigate the risks of a strong dollar, the Philippines must adopt proactive measures like diversifying export markets, strengthening regional cooperation and developing alternative growth drivers.

The BSP has already played a vital role in managing peso volatility through its market-driven approach, ensuring that the currency’s movements align with regional trends. Maintaining sound monetary and prudent fiscal policies is important. Moreover, maintaining the interest rate differential between the US and the Philippines is critical. Ultimately, whether Trump is “bad” for the peso and the Philippines hinges on the country’s ability to adapt to challenges and seize opportunities amid global shifts ahead.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

Be the first to comment