Reuters

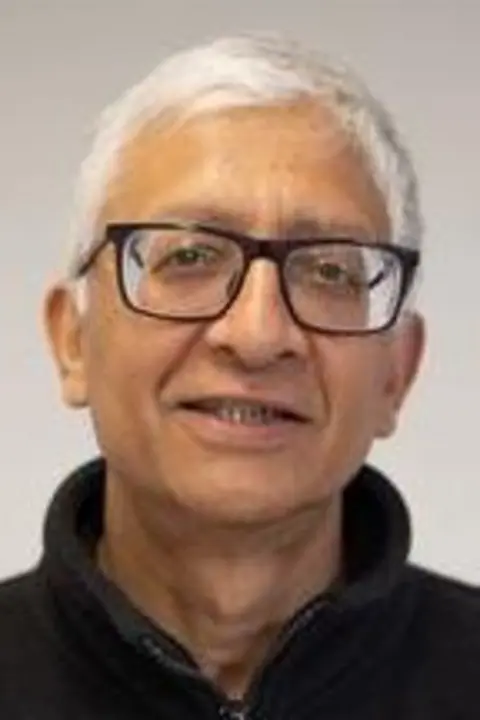

Reuters“I never imagined I’d be a victim of a scam,” says Dr Ravi Kumar.

“But here I am, a 53-year-old NHS consultant in intensive care medicine and anaesthetics, deeply affected.”

He lost £39,000 in May when scammers tricked him into transferring money into his Revolut account and giving them access to it.

He’d been saving the money for his teenagers.

“I was very depressed,” he adds. “My children are too young to share this grief with.”

Dr Kumar is one of more than 100 people who have told the BBC they feel poorly treated by Revolut after being scammed, following a Panorama investigation into the e-money firm.

For him the deception started when he received a phone call from someone claiming to be from American Express, his credit card company. They told him that fraudulent activity had been detected on his account.

They said they would report this to the industry regulator and that he should expect another phone call from Barclays, his high street bank, as money in that account might also be at risk.

A few hours later he received a call from someone who said they were from Barclays.

They told him to transfer his savings to his Revolut account for safekeeping while they carried out repairs.

He didn’t. At this point, Dr Kumar was becoming suspicious.

He wanted the person on the end of the line to prove who they were.

He was given a number to call – and when he did, he heard a familiar Barclays welcome message, which reassured him.

But it was still the scammer on the phone.

They told him again to transfer his money to Revolut as a security measure – and this time, Dr Kumar agreed.

After the transfer the scammer asked him to create two virtual debit cards in the app for “testing” purposes and told him to delete the app for extra safety.

Little did he know that this would allow them to spend thousands of pounds from his account – without him getting any notifications.

The next morning Dr Kumar reinstalled the Revolut app on his phone and found his account drained of £39,000.

The 25 transactions that had been made included purchases of luxury fashion and technology items from companies such as Selfridges, Apple and Currys.

He contacted Revolut to complain but they told him in a letter, seen by the BBC, that he would not be refunded as he had ultimately authorised the scammers to use the virtual debit cards.

Dr Kumar has hired lawyers to submit his claim to the Financial Ombudsman Service (FOS), which settles complaints between consumers and finance companies.

“I don’t know how long I’ll be able to pay for the legal help,” he says. “We cancelled two holidays, I’ve been working almost every Saturday since.”

He adds: “What’s even more disheartening than the financial loss is the indifference and lack of accountability displayed by Revolut.”

‘Its appeal might also be its weakness’

The e-money firm, founded in 2015 by two former bankers, has nine million customers in the UK and announced record annual profits last year of £438m.

Revolut was also named in more reports of fraud than any other major UK bank, according to figures collected last year by Action Fraud – the UK’s national reporting centre for fraud and cyber-crime.

In Dr Kumar’s case, the Revolut feature which enabled the scammers to spend his money was the creation of virtual debit cards.

These work the same way as a physical debit card except they only exist in the digital world.

They can offer customers more security because you can make online purchases without providing the details of your main card.

It’s among a list of features which some of Revolut’s competitors don’t offer.

Others include the option to hold money in different currencies, transfer it abroad, buy individual stocks, invest in commodities and access cryptocurrencies.

This range of features gives Revolut a broad appeal – it describes itself as an “all-in-one finance app for your money” – but it’s also what cyber security experts warn could be a weakness.

“It’s like putting all your eggs in one basket,” says Prof Mark Button, who researches cybercrime.

“If you have a product which can link to all the different aspects of your financial life, and you get compromised by a fraud or scam, then that is highly dangerous.”

While Revolut offers many features – one thing it doesn’t have is an emergency phone number you can call to freeze your account. You have to ask them using their app’s chat function.

A dedicated phone number might have helped Lynne Elms stop scammers taking £160,000 in seven minutes from her employer.

‘They controlled my computer’

She was working at her best friend’s cosmetics company in November 2022 when a scammer, who said they were from Revolut, told her the business’s account was under attack from fraudsters.

They said it was an emergency and she needed to move the money out of the account as soon as possible or risk losing it.

They convinced the 52-year-old to install a remote desktop application which they said would allow them to protect the account. It actually let them take control of her computer.

Over a period of seven minutes, the scammers pressured Lynne into authorising four transfers worth £160,000.

The accounts she was asked to transfer the money to had names including ‘refund’, ‘invoice’ and ‘cancel’.

It meant she saw these words in the notifications sent to her phone asking her to approve the transfers.

“Revolut were absolutely useless. It took me about three or four hours to get in touch with somebody,” says Lynne.

“Eventually Revolut froze the account. They told me there was nothing they could do. It felt like a one-liner to say sorry.”

Her employer has spent £70,000 on legal fees trying to get the money back.

An FOS investigator has recommended at least £115,000 should be refunded to them by Revolut, who are contesting the sum. A final decision by the Ombudsman is expected soon.

Revolut told us they were unable to comment on cases that were still ongoing with the FOS but said they were “sorry to hear about any instance where our customers are targeted by ruthless and highly sophisticated criminals”.

Addressing the fact that more than 100 people have contacted the BBC to complain about the firm, Revolut said such issues should be raised via their app.

They add that last year the number of fraudulent transactions using their service had been reduced by 20% and they had prevented £475m worth of potential fraud losses.

For victims who have lost money through scams on Revolut, the impact goes beyond financial stress.

“It felt like I was losing my business and my best friend,” says Lynne. “It was the worst time of my life. I never thought I’d get over it. I don’t think I have.”

Be the first to comment