BBC

BBCA woman who owed thousands of pounds on credit cards, catalogues and utility bills has praised staff at a money advice service for helping her to wipe her personal debts free of charge.

Karen, 60, from Sheffield, said she was left living “just like a hermit” after having to move house and building up sizeable debts following the end of a relationship.

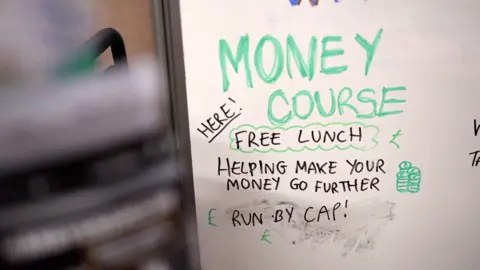

However, while visiting the S6 Foodbank in the city, she was referred to Sheffield Christians Against Poverty (CAP) whose staff helped her to apply for a Debt Relief Order, which can now be done for free.

Karen said freeing herself from all the money she had owed was “like a weight being lifted” and she had since learned how to budget better.

‘Burden of debt’

A £90 charge for applying for a Debt Relief Order was scrapped in April.

As a result, the number of applications in September 2024 was almost double the figure for the previous September, rising from 2,958 to a record high of 4,032.

Jayne Franklin, centre manager for Sheffield CAP, said the change had made a huge difference.

“It’s given us hope that we can get people debt-free quicker, so they haven’t got the burden of debt hanging around over them.”

Karen admitted that before she had sought advice over her debts she was “in a total mess” and she no longer even answered her door.

“I didn’t have anybody round, or my grandkids over for their tea, or anything like that, because I didn’t know what to feed them,” she said.

After getting help from Sheffield CAP and being told that she was able to apply for a Debt Relief Order at no charge, she said she now took much more care with her finances.

“I’ve never learned how to budget, but since I’ve been debt-free I’ve been on a budgeting course,” she said.

The scrapping of the £90 fee to apply for a Debt Relief Order has come at a time when an increasing number of people have continued to struggle with the cost of everyday bills.

New research for the Financial Inclusion Commission (FIC) carried out by Birmingham University suggests that one in five adults have increased their borrowing to cover higher living costs, while one in six families have no savings.

The FIC has called for what it describes as a National Inclusion Strategy to help people struggling with debts, and to give people support to access basics like a current account.

Meanwhile, debt advice service Money Wellness has warned that it was becoming increasingly easy to fall into the red.

In August 2023, staff at the service dealt with 408 people with buy now, pay later debts, but by August 2024 that number had risen to 1,258.

Sebrina McCullogh, director of external affairs at Money Wellness, said more and more people were “being forced into a position where they are using credit like buy now, pay later to just make it through to the end of the month”.

“They are using it for smaller transactions, as opposed to using it to spread the costs of those larger transactions which really is what buy now, pay later as a product is intended to be used for.”

Morgan, 25, from Liverpool, said he warned all his friends to steer clear of buy now, pay later.

He said that after he fell behind on a repayment to Klarna – the UK’s biggest buy now, pay later lender – he took out a credit card loan to pay it off.

Morgan said he had spent the past three years working his way out of that increasing spiral of debt.

“It just made me worse in life. I just wasn’t myself,” he said.

“I just turned to a closed shell, I was hot-headed, stressed, depressed.”

Morgan said it felt like all his friends had some kind of buy now, pay later loan, but added that he was determined never to take out another.

He said he had “learned my lesson now”, explaining that he considered himself lucky that he had managed to rent his current home for himself and his family despite his credit rating.

“I can just focus on getting my life back on track now,” he said.

In a statement, Klarna said it ran an eligibility check on every new purchase, adding that average customer debts were still well below that of credit cards.

The government has recently announced it planned to regulate the buy now, pay later sector.

The Treasury said it would introduce legislation to Parliament in early 2025, so the rules could take effect the following year.

Listen to highlights from South Yorkshire on BBC Sounds, catch up with the latest episode of Look North or tell us a story you think we should be covering here.

Be the first to comment